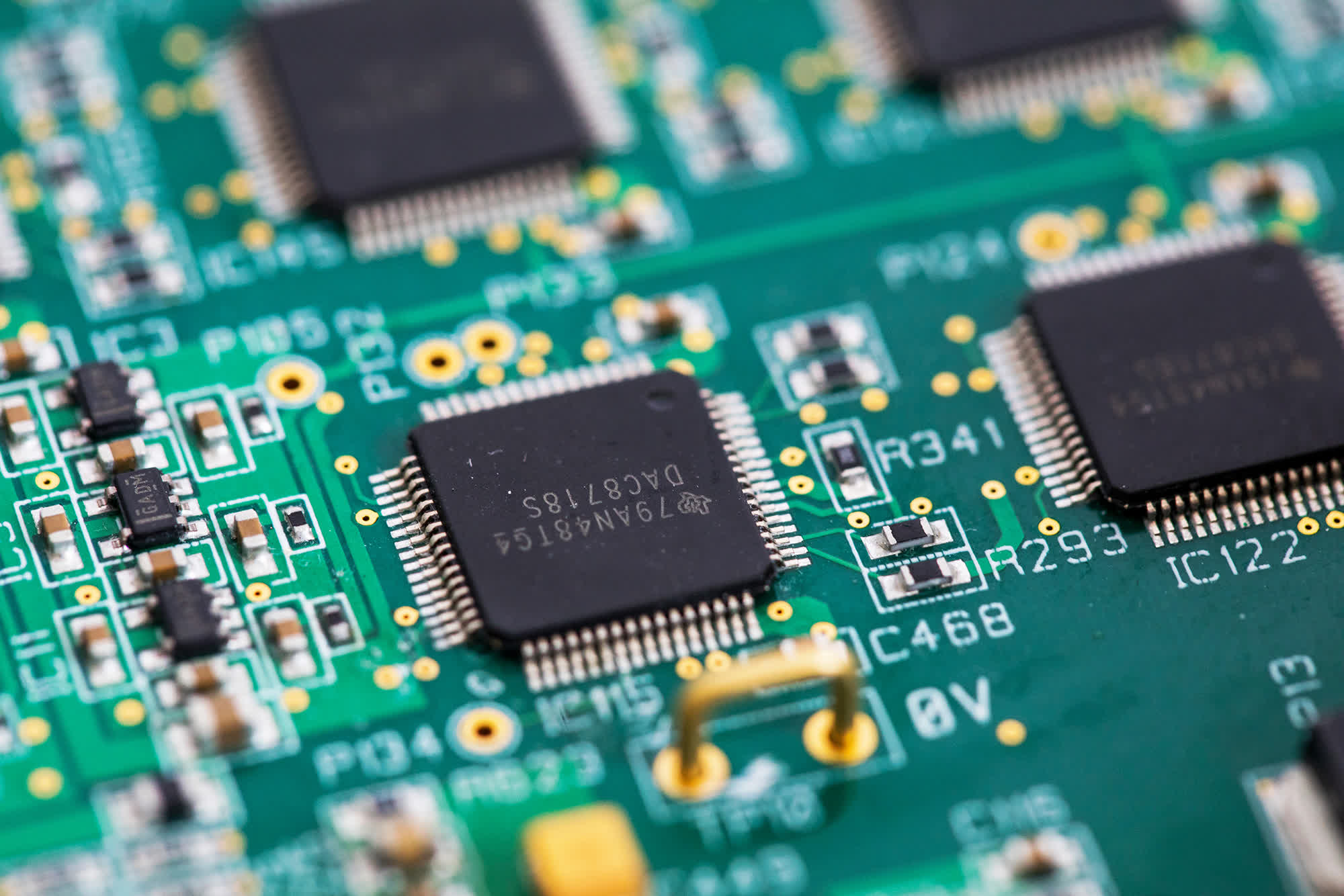

The big picture: Chip tool makers like ASML are more than happy about the semiconductor industry's rush to expand manufacturing capacity. However, the rippling effects of material and component shortages also apply to them, affecting their ability to meet the demand for manufacturing equipment. Some companies are now ripping out the chips they need from existing retail products.

The availability of GPUs has improved a lot over the past few months. It's been enough pressure to drive prices down much closer to MSRP than a year ago. That said, multiple industry leaders believe they'll continue to deal with a chip shortage until 2023 or even 2024, despite the best efforts of foundries to add more capacity.

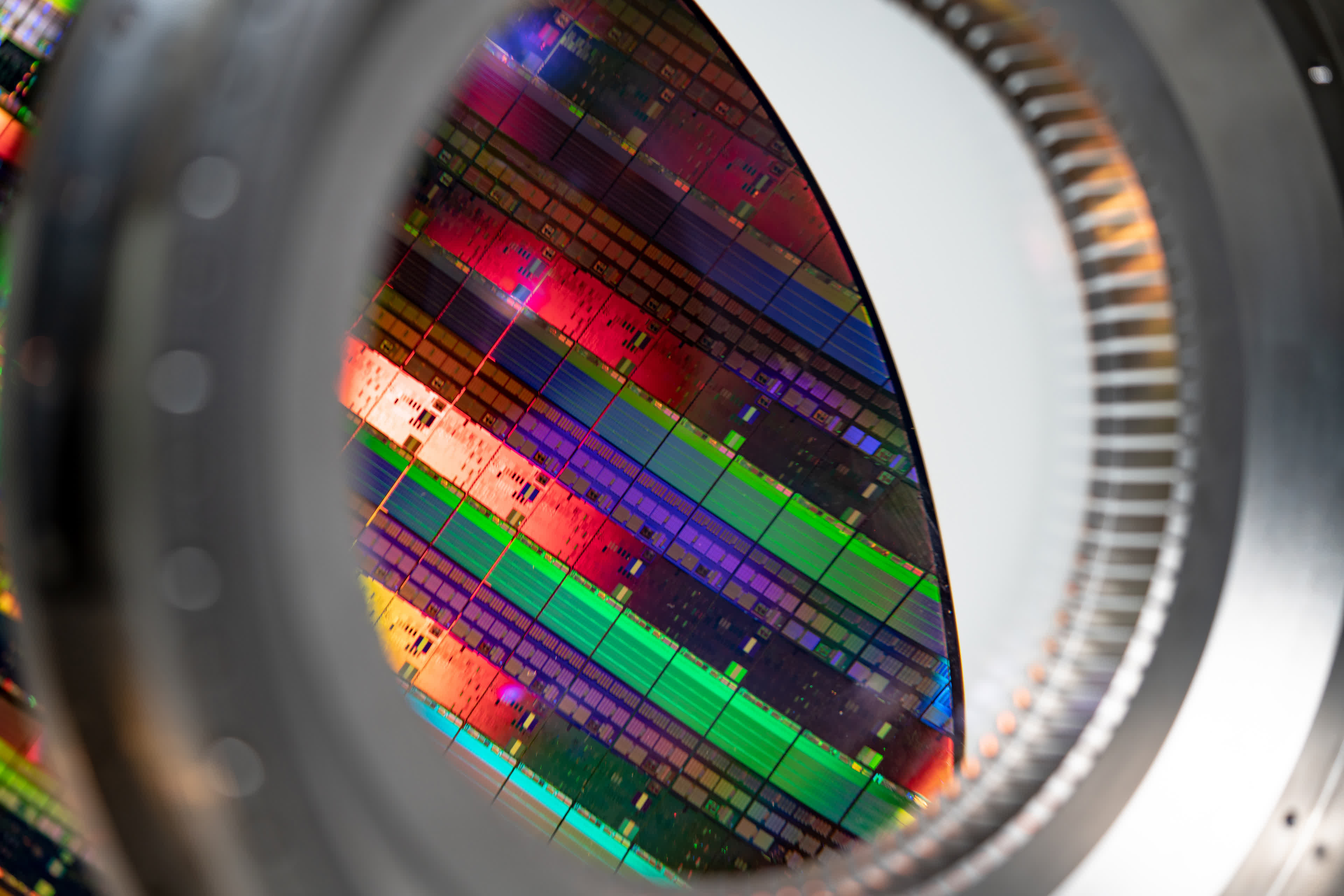

For lithography equipment supplier ASML, the added demand from foundries looking to fast-track their expansion is a blessing and a curse. On the one hand, the Dutch company is eager to deliver more advanced EUV machines to its customers. On the other, it has to contend with its own supply issues.

During an investor call, ASML CEO Peter Wennink said he expects the chip shortage to last well into 2023, mainly because his company can't supply the kind of volume needed by customers across the globe right now. This problem also affects other specialized chip tool manufacturers such as Applied Materials, KLA, and Lam Research. It all translates into longer delivery times stretching beyond 18 months.

Wennink explained that ASML could, at best, cover around 60 percent of the demand for advanced lithography machines. Furthermore, he noted that some companies --- including a major industrial conglomerate he won't name --- have recently started buying washing machines to extract the chips and repurpose them for their needs. This unorthodox recycling cuts the time and money cost of qualifying alternate chips making it more attractive than cutting back production or buying the necessary parts from resellers.

Last year, TSMC chairman Mark Liu said various distributors and go-betweens had been stockpiling chips throughout the pandemic. Liu also didn't mention names, but both TSMC and ASML are close with an extensive network of partners and customers. They have long warned that geopolitical instability and sanctions imposed on countries like China and Russia would push companies to create even more chaos in the tech supply chain.

Lam Research CEO Timothy Archer echoed Wennink's remark that supply-related delays will affect how much factory equipment can be manufactured in the coming months. Even if companies like TSMC, Samsung, and Intel could somehow secure enough tooling for their new factories, major wafer suppliers won't be able to keep up with demand until 2024.

Different industry sectors will be affected to varying degrees, and automakers are still dealing with the effects of canceling chip orders early on in the pandemic. Now that they're scrambling to compete in the EV market, some like Rivian CEO RJ Scaringe believe the chip shortage will look like a "small appetizer" compared to the coming undersupply of Lithium-ion batteries.